I’m a little late in posting this here on FR, but the editorial below recently ran in the Riverside Press Enterprise:

Deficit DéjÀ Vu

California’s Democratic majority refuses to learn from budgets past

By JIM BATTIN

By JIM BATTIN

Our budget picture just seems to keep going from bad to worse — and I fear that we haven’t hit bottom yet.

Recently, the state’s nonpartisan budget analyst revised the projected deficit upward to $16 billion. We are absolutely going in the wrong direction and real, substantial changes are needed.

Considering my fellow Senate Republicans and I were branded "obstructionists," "whackos" and "terrorists" by the Democratic leadership for holding out for a mere $750 million in reductions during last year’s budget talks, you can imagine what this summer’s negotiations may hold in store for us.

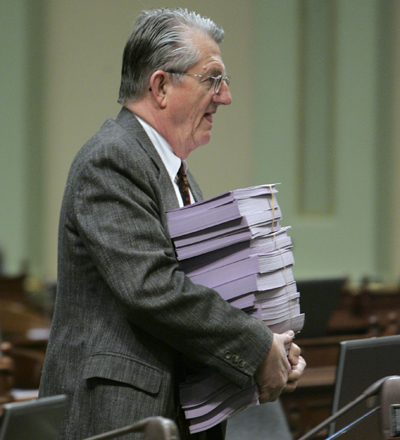

AP photo

Assembly Clerk Larry Murman on Feb. 15 delivers a stack of legislation in Sacramento. In the past five years, state spending has grown by $25 billion.

At the heart of the struggle are two distinct and contrasting fiscal philosophies, which in Sacramento tend to break along party lines. My colleagues on the left believe in more spending for bigger government, while conservatives like me on the right urge smaller, more efficient government that never spends more than it receives in revenues.

The Democrats clearly laid out their intentions to raise taxes when Senate leader Don Perata, D-Oakland, said recently, "This is going to be the fight of a lifetime." And when asked how Democrats propose to make up the difference, Perata said: "Raise taxes. That clear enough? Raise taxes."

Rather than depending on rhetoric alone, consider this: In the past five years, state spending has grown by $25 billion, well outpacing increases in inflation and population growth. Medi-Cal, government-paid health care for the poor, offers acupuncture and chiropractic benefits to enrollees.

How many middle-class families have those benefits in their health insurance package?

Ramping Up Welfare

Or consider welfare, a program that is supposed to be a temporary transition to work. The benefits were limited to 60 months under President Clinton, but it seems that five years of assistance is not enough for the Democratic majority here in California, and they’ve generously extended it.

Now consider this: The past five years followed the fiasco that was the 2003 budget agreement. Remember 2003? Tripling the car tax, stealing from local government coffers, and raiding transportation (gas tax) funds, all in an effort to paper over what would eventually become a huge, multibillion-dollar deficit.

Which, by the way, resulted in the recall of Gov. Gray Davis. I’m not quite sure, but it seems there may be a lesson to be learned in there somewhere.

All sarcasm aside, it is imperative that fiscal conservatives in the Legislature stand up and act like fiscal conservatives.

As much as I would prefer to allow the Democrats to receive full credit for this mess, the fact remains that a few Republicans are needed to pass the budget every year. In 2003, a few more were required, since even a couple of Democrats couldn’t bring themselves to accept that misguided budget.

While the implementation will require tough choices and hard work, the fiscally conservative message to government is simple: Live within your means and create a business-friendly environment by staying out of the way and letting the entrepreneurial spirit flourish.

The Rich Just Move

In their study "Rich States, Poor States," economists Arthur Laffer and Stephen Moore note that more than 5,000 of the approximately 25,000 seven-figure-income families moved out of California in the early part of this decade.

The resulting loss of their would-be tax payments accounted for half of the $14 billion deficit we faced in 2003. Because of an ineffective and overly intrusive government, $7 billion simply "moved out" of our economy.

Since the legislative majority seems intent on spending more money than the state takes in, its budget "solutions" invariably consist of more borrowing, more gimmicks and continued calls for more taxes.

The mid-year reductions taken earlier this month put this approach in plain view. Borrowing and accounting tricks were utilized to yield $5.4 billion in new revenues, while legislators could come up with just $1.5 billion in reductions.

History is clear — raising taxes will not get us out of this budget crisis. When former Gov. Pete Wilson and the Legislature raised taxes in the early ’90s, revenues plummeted.

If we expect to actually raise revenues, we need to focus on revitalizing the economy and taking actions that will stimulate job creation and economic growth, instead of adding to a tax burden that’s already driving the most productive Californians to other states.

More-recent history, most notably 2003, should serve as a lesson in what not to do in the face of a huge deficit. If we ignore the mistakes of our (recent) past, and refuse to take our medicine, we may experience what Yogi Berra called, déjÀ vu all over again.

Jim Battin, R-La Quinta, represents the California Senate’s 37th District, which includes most of Riverside County. He also serves on the Senate Appropriations Committee.

March 24th, 2008 at 12:00 am

Where can one start with this one?

Let’s try with getting non-biased sources for your claims. The well-respected PPIC found that it’s a myth that companies and people are leaving California in droves for economic reasons.

Instead of blaming your colleagues, why not focus your attention on the Bush Administration, which is presiding over this recession and has failed to give California its fair share of federal funding? Nah, that would make too much sense.

Glad to see you think California is spending way too much on educating our kids, relieving traffic congestion, and providing a safety net for our neediest citizens. Good fodder down the road.

But more importantly, Senator, where is YOUR plan to balance the budget? The silence is indeed deafening.