Longtime FR reader Joe Armendariz sent over this commentary, which echoes on what I penned this morning. I hope you enjoy it as much as I did…

This isn’t the first time and it certainly won’t be the last time Pete Wilson gets it wrong. Yesterday he defended the indefensible by suggesting his decision to raise taxes meant "having the guts to do what should be done". Wilson was wrong in 1993 when he raised taxes and he is even more wrong now by defending that bad decision in a clumsy endorsement of Doug Ose over Tom McClintock. And not only that, Wilson has done what another former california Governor implored Republicans never to do; Wilson broke the 11th commandment by attacking Senator Tom McClintock. But I digress.

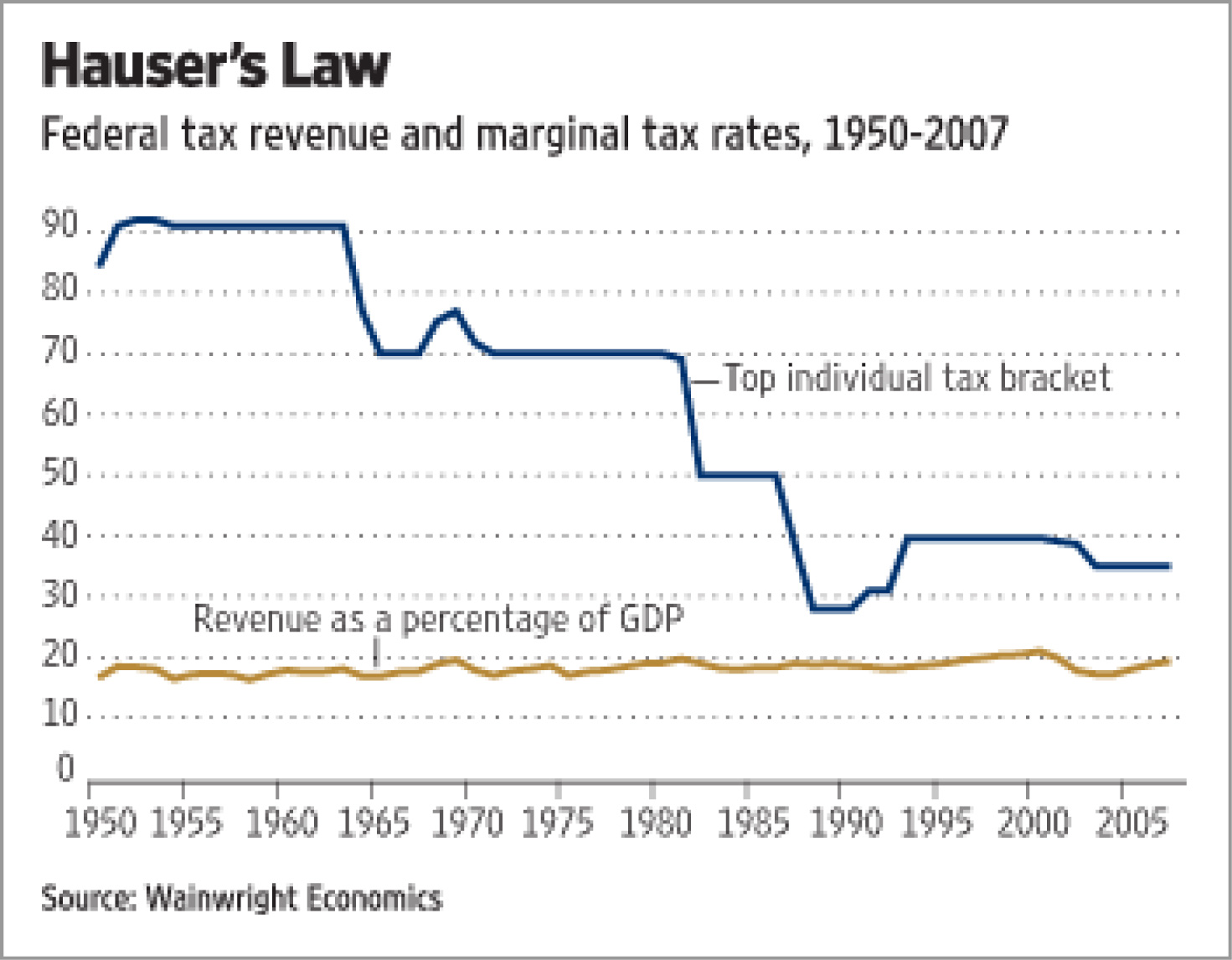

Republicans should make no mistakes about the following: raising taxes in hopes of balancing the state budget, as Wilson attempted to do in 1993, is never sound economic policy, because higher tax rates do not generate higher revenues (see chart below). Therefore, it is not the solution to solving our budget woes and good economic conservatives like Tom McClintock understand this truth too well. McClintock can’t be duped into going along to get along when going along will result in economic damage to the U.S. economy and by extension, America’s families.

UNEQUIVOCAL Truth #1: Deficits DO NOT cause recessions! Recessions cause deficits. And recessions, by the way, are not born of "immaculate conception", they are the result of bad policies, particularly bad economic policies. And the absolute worst economic policy of all is to raise taxes on the productive sectors of the national, state and local economy in hopes that it will result in more revenue for the government to spend on things we don’t want or need. Indeed, the last thing any ill economy needs while laying on the operating table is the economic equivalent of bloodletting. And that is what tax increases are, bleeding the patient of their financial lifeblood and their incentive to take more risks and produce more wealth.

UNEQUIVOCAL Truth #2: If you tax something, you get less of it. And unfortunately this economic truism seems to know no partisan boundaries. Even though God created Republicans to lower taxes, too many Republicans like Pete Wilson, in the past, and some of my favorite Republicans today, can’t seem to resist the forbidden fruit of political temptation and end up falling by committing the economic sin of supporting higher taxes on the things we need more of such as gasoline and oil (think crude oil production tax).

UNEQUIVOCAL Truth #2: If you tax something, you get less of it. And unfortunately this economic truism seems to know no partisan boundaries. Even though God created Republicans to lower taxes, too many Republicans like Pete Wilson, in the past, and some of my favorite Republicans today, can’t seem to resist the forbidden fruit of political temptation and end up falling by committing the economic sin of supporting higher taxes on the things we need more of such as gasoline and oil (think crude oil production tax).

But this isn’t rocket science. Indeed, the foolishness of raising taxes and the wisdom of cutting taxes has been demonstrated time and time again. Starting with Calvin Coolidge, then with John Kennedy, next with Ronald Reagan, again with Bill Clinton (think cap gains cuts and NAFTA) and then yet again with George W. Bush. Each and every time these U.S. Presidents cut tax rates, the economy produced more revenues because the tax reform resulted in a more efficient economy with higher economic output. I.e., a larger economic pie was created as a result of removing the barriers to earning, saving, trading, producing and investing.

Tom McClintock, who remains the Gold Standard in my book, understands this stuff all too well and the last thing the Republican Party needs or wants in Congress, especially now, is someone who doesn’t know or isn’t sure about this important economic history. And I’m not suggesting Doug Ose doesn’t agree with the above views, but, after receiving what I consider the most uninspiring endorsement since Cher endorsed Ross Perot, Ose should come out and set the record straight regarding raising taxes and cutting taxes when budget equilibrium is on the line. Inquiring minds want to know.