Try to explain to a person on the street that Governor Jerry “Moonbeam” Brown is captive of special interests that are out there to the left of him, and you are likely to get a look of pure disbelief. Yet, with the news today that Governor Brown stands ready to abandon his already massive proposal to increase sales and income taxes, and will instead work with the ultra liberal California Federation of Teachers on a measure that represents even more massive increases the size and duration of proposed tax increases (the CFT has been working to qualify their own tax increase measure that was larger than the one originally proposed by Brown) it’s pretty clear that this is exactly what is going on.

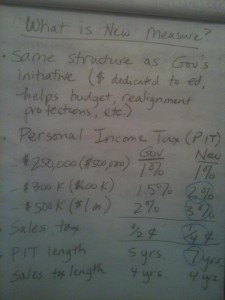

In what is being dubbed “compromise” by our friends in the main stream media, this new deal between “left and lefter” modifies Governor Brown’s previous proposal as follows (to quote Steve Harman of the Bay Area News Group) — “Brown’s revised plan would put a larger burden on individuals who earn $500,000 a year — raising their income tax rate by 3 percentage points instead of 2, while reducing his sales tax hike proposal from a half cent to a quarter cent, the source said. He is also expected to extend the period of the income tax hike from five years to seven.”

The first question that comes to mind is how long a tax increase has to last before it can’t really be credibly called “temporary” anymore? What about if the taxes sunset after 20 years? 50 years? These tax increases would be around for so long that Governor Brown could be re-elected, serve an entire second term, and his successor elected before they even would expire.

The second question is what kind of sense it makes to take a state government that is already over-dependent on the state’s highest income earners for too much of its tax revenue, and ratchet that up even more? Apparently general complaints about the volatility of the state’s tax revenues from year to year are outweighed by the voracious appetite of the left for more revenues.

The only common sense coming out of the State Capitol these days comes from Republicans who understand that the tax rates currently on the books for Californians are more than adequate to fund state responsibilities and services — especially when the economy isn’t moribund — That is why the focus of Republican legislators is on repealing state laws and regulations that serve to impair economic growth. It is by turning around our state’s economy that we will increase the income to all Californians, and thereby increase tax revenues to the state. What is that saying? A rising tide lifts all boats. Unfortunately for Californians, Republicans don’t have enough members of the legislature to drive policy outcomes.

The details of the plan, on a dry-erase board in Senate President Steinberg's Office (Photo Credit: Ben Adler, CA Public Radio)

It is literally unknown whether this lurch to the left by Brown on this tax increase proposal will cause the big business community (as represented by the California Chamber of Commerce and the California Business Roundtable) to actually come out against the Governor’s proposal. In recent headlines we have read where both organizations, while coming out firmly against other tax increase proposals have been noticeably silent on Brown’s proposal. It has been a matter of much controversy that big business interests have thrown in with Brown — as demonstrated most recently by several things — the current lack of opposition to Brown’s previous tax increase plan, the Chamber’s PAC actually hiring Brown’s top political adviser to advise them on political matters, and the behind-the-scenes spectacle of big business running for the hills and abandoning a spending cap measure for 2012 after Brown made phone calls (very similar to the Chamber stopping their ads critical of Brown when the then-Attorney General started making calls). I am prepared to welcome any and all comers to the team opposing the raising any taxes on Californians. But I am not holding my breath. Thank goodness for these guys.

On a closing note, let’s all get ready for more favorable treatment by Attorney General Kamela Harris as she uses her office to help her political allies, the state’s public employee unions. Whether it is warping the title and summary of proposal ballot measures from summary to advocacy, or now fast-tracking the necessary approvals to get this new tax-increase initiative onto the streets (where the window to collect signatures is narrow, but doable when you have vast sums of union money) — it’s good to have the AG in your pocket…. (It is said that Brown will continue to gather signatures on his initial tax proposed to hedge against the unlikely event that this new “compromise” plan fails to gather the requisite signatures.)

March 15th, 2012 at 9:46 am

The madness of King Jerry….

Doubt this our Stamp Act or will you see masked rich guys shucking tea into the Sacramento! BUT…..

Continued reliance on a steeply “progressive” income tax is not smart government….it is a prelude to going for the real jackpot…Proposition 13 once the Socialists

reach 2/3rd’s voting power!

Only fools will make sizeable fixed asset investments in California or invest heavily in human asset development…

Be nimble…be mobile…be fluid…the fat lady is about to politely wave her hankee and take some ungraceful bows….

March 15th, 2012 at 2:21 pm

So, Jon, why are you shocked that Governor Brown is playing on the left? And don’t you now wish you and your friends had not trashed all those fiscally conservative and moderate on social issues (re: gay marriage and choice neutral or friendly) Republican candidates? Just think, Jon, if all those moderate Republicans had been elected to the legislature and to constitutional offices, you would not have to worry about Governor Brown increasing taxes. We would have a state that runs efficiently and economically. But, Jon, you reap what you sow.

March 15th, 2012 at 2:53 pm

No use pointing pinkees….Baron Romney will be here soon to take all our fears away!!!