On Wednesday, Governor Arnold Schwarzenegger announced his intention to sign several bills in response to the economic challenges faced by the subprime real estate market downturn — bills aimed at strengthing disclosure laws.

On Wednesday, Governor Arnold Schwarzenegger announced his intention to sign several bills in response to the economic challenges faced by the subprime real estate market downturn — bills aimed at strengthing disclosure laws.

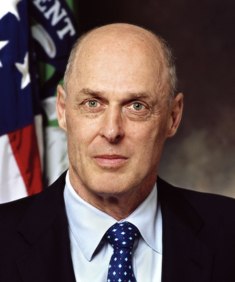

We need to contrast these appropriate responses with the apparent desire by President Bush’s Treasury Secretary, Hank Paulson, to take a page out of the Presidency of Jimmy Carter, and promote welfare-statist approach to dealing with the negative effects of the market downturn on subprime lenders and their customers.

Did Secretary Paulson (pictured) learn anything at those Ivy League schools he attended? Even though some see him as a Godfather figure, you don’t have to be an Ivy Leaguer or Wall Street honcho to understand that rewarding poor behavior helps bring about more poor behavior. Most of us learned that lesson in kindergarten.

**There is more – click the link**

October 5th, 2007 at 12:00 am

That clanking sound I hear is Jon going off the rails once again. There is nothing wrong with helping people who were sold a sub-prime teaser rate mortgage with a new fixed rate loan. If the federal government does this, it helps keep people in their homes and that is, to borrow a phrase, a good thing. It is also a good thing to help the banking industry stay stable and willing to make loans. I guess Jon is one of the lucky favored few who pay cash for everything and have no debt. Good for him. But for the rest of us, we need to finance our home. And g-d bless us one and all.

October 5th, 2007 at 12:00 am

Actually, there IS something wrong with taxing one homeowner to subsidize the mortgage situation of his or her neighbor.

The ability of America to be the home of the free, with liberty for all of our people, is personal responsibility.

It’s not like we’re talking about some sort of “magic wand” that creates billions of dollars to bail out this industry. It is coercively obtained tax dollars.

October 5th, 2007 at 12:00 am

Once again Jon, you are off the rails. By your analysis, we would have no Land Grant Colleges (the greatest Republican, President Lincoln, brought forth that idea) or national railroads (the federal government gave the national railroads land on both sides of the track – the right of way – to back the bonds the railroads sold to finance their building) or the Homestead Act (another way President Lincoln helped the people settle the nation) or tariffs; and I could go on and on with examples of how the federal government “bailed out” our citizens and our businesses, including banking, but I won’t belabor the point. The point is, there is a place for government action that helps the people and that is why we have government – to help and protect the citizens. But being one of the favored debt free few, I guess you, Jon, wouldn’t understand that point.

October 5th, 2007 at 12:00 am

Hell, if keeping people in houses is a good thing, then wouldn’t it be better just to give all non-homeowners a federally subsidized house?

October 5th, 2007 at 12:00 am

It seems to me, Mark, that taking the interest cost of a home mortgage off your income tax is the government giving people a federally subsidized house. So do you want to end the home mortgage interest deduction? In the interests of making sure there is no “federally subsidized house” of course.

October 6th, 2007 at 12:00 am

The U.S. Constitution is very clear in Article 1, Section 8… the Framers gave the Federal goverment very limited powers to tax and spend. The Federal government could only tax and spend for three reasons: 1) to pay the debts 2) provide for the common defense and 3) provide for the general welfare. Everything else was left to the states. Please explain how a bail out fits in here?

October 6th, 2007 at 12:00 am

I think number 3 in your post, Ken, covers this issue. I realize this is a difficult ethical issue for some people. Do we throw the people who took sub-prime loans so they could join in the American dream of home ownership under a bus? Or not? I prefer to help people if we can.

October 9th, 2007 at 12:00 am

No Bob. You prefer to hurt people. You demand that we reward the people who were fiscally irresponsible and took out loans they knew they couldn’t pay off (usually planning on flipping the house before the higher payments came due) by taking money from people who used common sense, lived within their means, and didn’t buy houses they couldn’t afford – whether by buying something less expensive (e.g., smaller or in a less desirable area) or by not buying at all.

Shame on you.

October 9th, 2007 at 12:00 am

Why Nick, I have no power to demand anything of you. But I do suggest that the milk of human kindness should be a major part of Republican dogma. If you disagree with me on this point, that is OK with me. You are entitled to your opinion.

October 10th, 2007 at 12:00 am

You do have the power to demand. Luckily, unless you’re in office, I and everyone else have the power to ignore your demands.

Human kindness doesn’t consist of rewarding the irresponsible by making other people pay their bills. That’s immoral in addition to being economically counterproductive.

And you too are entitled to your opinion, no matter how much damage it would cause if it ever got enacted.

October 11th, 2007 at 12:00 am

I see, Nick. So you don’t believe in the precept “Whatever you do for the least of my brothers and sisters, you do for me.” Ah well. So it goes.

October 12th, 2007 at 12:00 am

Liberal Christians often make Jesus sound like Robin Hood, but your version of Jesus sounds a lot more like Tony Soprano. He takes from everyone else to give to his criminal associates. Your view would reward participants in loan fraud (and that’s exactly what many of the people now complaining that they can’t pay their mortgages as soon as the teaser rate expired are) at the expense of honest renters and homeowners.

By the way, thank you for being honest enough to admit you want to impose your religious beliefs as law.

October 12th, 2007 at 12:00 am

My goodness, Nick. You are so angry. Why is that? All the government needs to do is act as cosigner for new fixed rate loans for those people who took “teaser rate” adjustable loans which are now adjusting to interest rates that the borrower cannot afford. That is all. No vast left wing conspiracy here. Just the same thing that the federal government did for the Chrysler Corporation (and which did not cost the federal government one dime as Chrysler paid off the guaranteed loans early). This is not a liberal or conservative issue; it is an issue about preserving the American dream of home ownership for all our citizens, including those who are, perhaps, less, um, honest (?), than our good friend Nick tells us he is.

October 15th, 2007 at 12:00 am

Cosigning loans for people who we know can’t pay back their loans (or do you think that people buying houses for 8 to 10 times their annual income actually had realistic plans to pay off their mortgages?), with collateral that’s often worth less than the amount loaned? That’s insane.

You’re from the Jimmy Carter wing of the Republican Party.