Environmentalists claim global warming can be mitigated, but only by if humans are forced to reduce greenhouse gas emissions. This pseudo-science is what the California Air Resources Board has adopted to control human activity.

If this sounds a little woo-woo, remember the CARB is the state agency which, under Assembly Bill 32, the California Global Warming Solution Act of 2006, expanded its mandate in order to link up in a cap and trade scheme with Quebec, and Canada’s international Ecosystem Marketplace offset program.

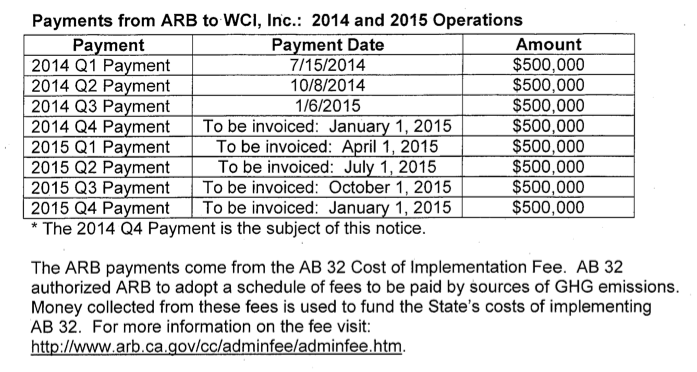

Even more disturbing, the cap and trade funds extorted from California businesses by way of carbon offset auctions, are being laundered through Western Climate Initiative, Inc., “WCI Inc.,” a Delaware Corporation formed by the California Air Resources Board under Mary Nichols, CARB Chairwoman.

When the WCI Inc. was first discovered, Nichols cavalierly assured members of the Legislature that there would be access to WCI Inc. records, but is allowed to be short tempered and prickly with legislators’ questions about the operations and finances of her agency.

In the beginning…

On November 28, 2011, WCI Inc. was established as a not-for-profit corporation in the state of Delaware. The California Air Resource Board set up a way to hide billions of dollars in Cap and Trade revenue through a corporation “owned” by the public. This is shady and dubious, but not surprising. The State of California used to set up redevelopment projects as Delaware Corporations. Delaware Limited Liability Corporations are anonymous shell corporations that never reveal individual ownership or records.

The California Air Resources Board, with help from former Democratic Assembly Speaker John Perez, D-Los Angeles, figured out a way to exempt itself from the state’s open meeting act in a piece of last minute legislation. Language was secretly placed into a trailer bill in the 2011 state budget, which now allows the California Air Resources Board to conduct state business without any transparency. Government Code 11120, the Bagley-Keene Open Meeting Act, is explicitly exempted in the language of budget trailer bill SB 1018.

In short, the CARB is now providing a legal form of money laundering by funneling cap and trade auction revenues into WCI Inc., — a shell corporation funded with California public funds.

The Perez trailer bill language appeared to be an illegal statute, because it does not conform with the California Constitution, Article I Section 3, which states, “The people have the right of access to information concerning the conduct of the people’s business, and, therefore, the meetings of public bodies and the writings of public officials and agencies shall be open to public scrutiny.”

In 2012, a Joint Legislative Audit Committee attempted to hold CARB accountable with the threat of a six-month state audit. But the committee chairman, then-Assemblyman Ricardo Lara, D-Bell Gardens, surprised everyone when he nixed the plan after having made the pretense that he was on board. Lara is now a State Senator.

CARB and AB 32

In 2006, the Legislature promised that AB 32 would help clean the environment while still protecting the economy. Supportive legislators promised that utility and gasoline costs would not increase with the implementation of the climate change law.

The opposite has happened, and businesses are now being severely taxed and extorted by the CARB just for doing business in California. Most business owners are up in arms over CARB’s inability to justify its fees, or even explain where the money is going.

Public Records Request

In 2012, 13 associations representing CARB-regulated parties, small businesses, and taxpayers, filed a Public Records Act request to obtain substantiation for how the initial $57 million, for the program’s first two fiscal years, was spent.

CARB grudgingly released some records sporadically, but withheld nearly 50,000 pages of documents. The released records did not provide a insight into where the $57 million went.

An independent economist was brought in to examine CARB’s financial records and reported, “Only 46 percent of 2008-2009 expenditures and only 36 percent of 2009-2010 expenditures, claimed by CARB were documented. “And only 40 percent of CARB’s claimed AB 32-related costs were documented — with 60 percent remaining unsubstantiated, including expenditures of more than $26 million for salaries and almost $4 million for administrative overhead over a two-year period.”

As a result of the economist’s report, then-Sen. Bob Dutton filed a request with the legislative audit committee hoping to discover:

- If CARB’s cost allocation methods comply with applicable laws;

- Were CARB’s methods for allocating salaries, benefits and operating expenses reasonable, and did they comply with applicable state laws and Department of Finance regulations for accounting for agency expenditures?

- What method did CARB use to determine the $62 million in total required revenue for 2011-2012?

At the time, Dutton said that he had been on the Budget Committee for six years, and only found out about the existence of WCI Inc. by chance from another colleague in passing, proving that transparency was just another CARB lie.

Emboldened by their success at beating back efforts at transparency, the CARB is now considering offering carbon credits for preserving forests and plantations in Mexico, Colombia, and other developing countries.

CARB claims that it created the WCI Inc. “to perform administrative and technical services to support the carbon trading market, including market monitoring of allowance auctions, and market trading of compliance instruments.” But they’ve never explained why it was registered as a Delaware corporation, and not registered instead in California, just as the businesses CARB regulates are.

Even now, the CARB just sent a report January 27, 2015 to the Legislature explaining expenditures to the WCI Inc. of more than $150,000. But the documents are short on details and long on just barely enough behind-covering measures.

This is your runaway state government on steroids.