It’s bad enough that California’s gas tax is among the highest in the nation. It’s even worse that the gas tax goes up whenever gas prices rise.

Today I released data showing that high gas prices have resulted in a record windfall for government at the expense of California consumers.

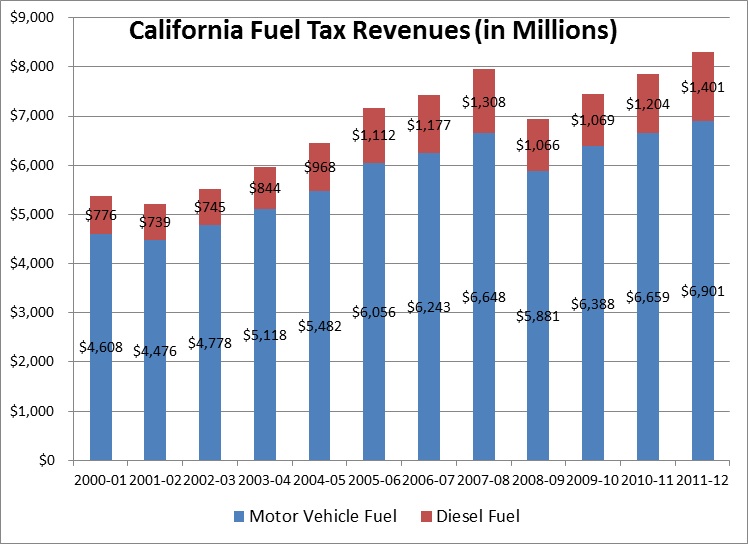

California motorists paid a record $8.3 billion in state and local fuel taxes during the 2011-12 fiscal year.

From July 1, 2011 to June 30, 2012, the California State Board of Equalization collected $6.9 billion in motor vehicle fuel taxes, up from $6.7 billion the prior year. Excise tax revenues accounted for $5.2 billion, while sales tax revenues accounted for $1.7 billion.

Over the same time period, the state collected $1.4 billion in diesel fuel taxes, up from $1.2 billion the prior year. Excise tax revenues accounted for $343 million, while sales tax revenues accounted for $1.1 billion.

What’s particularly concerning about these numbers is that they would have been even higher had the Governor been successful in extending the higher sales tax.

Had the 1% temporary sales tax not expired last year, Californians would have paid an additional $96 million in diesel tax last fiscal year. Furthermore, California’s 2010 fuel tax swap law would have required a larger motor vehicle fuel excise tax rate increase, costing Californians more than half a billion dollars extra in the 2012-13 fiscal year.

According to the American Petroleum Institute, California’s gasoline taxes and fees, averaging 68.9 cents per gallon, and California’s diesel taxes and fees, averaging 77.1 cents per gallon, both rank second highest in the nation.

Tell that to the next person who says we need higher taxes.

Tags: Board of Equalization, BOE, budget, budget deficit, businesses, California, economy, jobs, spending, tax, taxes

This entry was posted

on Wednesday, October 31st, 2012 at 10:28 am and is filed under Blog Posts, Commentary.

Gas Tax Revenues Set New Record

Posted by BOE Member George Runner at 10:28 am on Oct 31, 2012

It’s bad enough that California’s gas tax is among the highest in the nation. It’s even worse that the gas tax goes up whenever gas prices rise.

Today I released data showing that high gas prices have resulted in a record windfall for government at the expense of California consumers.

California motorists paid a record $8.3 billion in state and local fuel taxes during the 2011-12 fiscal year.

From July 1, 2011 to June 30, 2012, the California State Board of Equalization collected $6.9 billion in motor vehicle fuel taxes, up from $6.7 billion the prior year. Excise tax revenues accounted for $5.2 billion, while sales tax revenues accounted for $1.7 billion.

Over the same time period, the state collected $1.4 billion in diesel fuel taxes, up from $1.2 billion the prior year. Excise tax revenues accounted for $343 million, while sales tax revenues accounted for $1.1 billion.

What’s particularly concerning about these numbers is that they would have been even higher had the Governor been successful in extending the higher sales tax.

Had the 1% temporary sales tax not expired last year, Californians would have paid an additional $96 million in diesel tax last fiscal year. Furthermore, California’s 2010 fuel tax swap law would have required a larger motor vehicle fuel excise tax rate increase, costing Californians more than half a billion dollars extra in the 2012-13 fiscal year.

According to the American Petroleum Institute, California’s gasoline taxes and fees, averaging 68.9 cents per gallon, and California’s diesel taxes and fees, averaging 77.1 cents per gallon, both rank second highest in the nation.

Tell that to the next person who says we need higher taxes.

Tags: Board of Equalization, BOE, budget, budget deficit, businesses, California, economy, jobs, spending, tax, taxes

This entry was posted on Wednesday, October 31st, 2012 at 10:28 am and is filed under Blog Posts, Commentary.