It’s tragic how some desperate states experiencing runaway state government spending are raising their income taxes to soak the rich. But for those states such as California, it’s MORE tragic that many other states are now moving to cut or eliminate their state income tax on corporations and/or individuals. This little-reported tax cutting trend rates wider publicity.

Why would states CUT their income tax collections? Could it be that they want our refugee millionaires and businesses, and don’t want to lose theirs? Or maybe they are just stark raving mad (the dismissive liberal explanation).

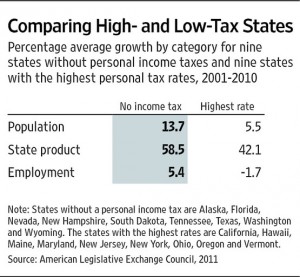

Here’s the obvious reason — low tax states do better economically than high tax states. Below is the latest quick bottom line comparison:

You WILL want to read this WALL ST JOURNAL editorial. It names names (actually, states) — Oklahoma, South Carolina, Kansas and Indiana. In addition, Idaho, Maine, Nebraska, New Jersey and Ohio are debating income-tax cuts this year. Already 6 other states charge zero income tax.

http://online.wsj.com/article/SB10001424052970203889904577200872159113492.htm

FEBRUARY 8, 2012

The Heartland Tax Rebellion

More states want to repeal their income taxes.

. . .

RIDER CONCLUSION: Liberal activists will not be dissuaded from their Jihad against the wealthy — it’s as much about punishing the rich as it is about raising more revenue. But many less myopic California voters will likely find this information illuminating — and unsettling.

February 23rd, 2012 at 10:56 pm

Libs in Rhode Island, Illinois, New Jersey, New York, New Jersey, Wisconsin are tax and spend fanatics……California worse!!!