The Governor proposed, and the Legislature is considering, imposing a 9.9 percent severance tax on oil production in California.

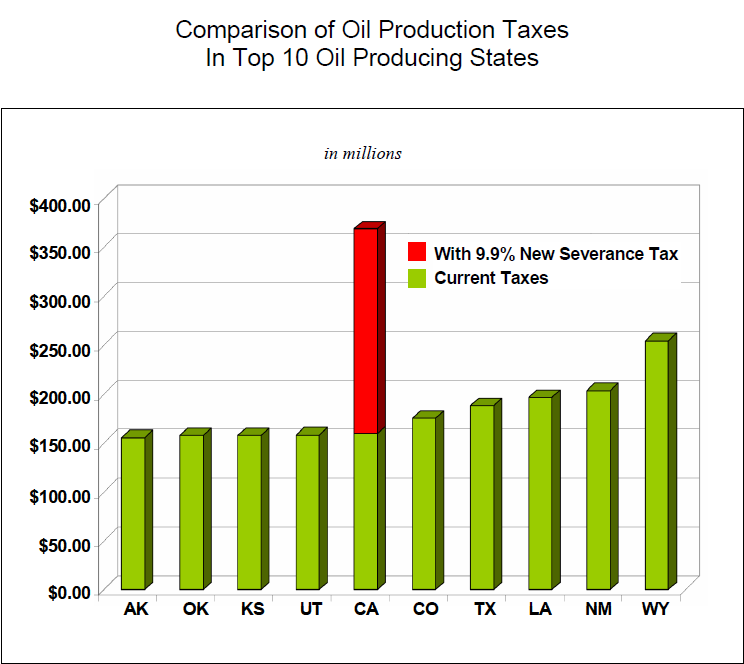

The chart (shown below) shows where California compares to other oil generating states. The bottom line is that California is already among the most heavily taxed states in the country relative to oil production. If the Legislature agrees to impose this new oil tax, California’s combined taxes on petroleum would make it far and above the highest taxed state in the nation.

In addition, the new oil tax will reduce the supply of oil produced in California, result in close to 10,000 lost jobs in California, and increase our dependency on oil imports (including from Venezuela, which is presided over by despotic leader Hugo Chavez). Since the transportation, distribution and refining cost of importing oil are greater than the costs associated with California oil production, consumers will pay higher gasoline prices as a result of the severance tax.

Source: An economic and fiscal impact analysis of the proposed oil tax (attached below) was prepared by Dr. José Alberro and Dr. William Hamm of the Law and Economics Consulting Group (LECG). Dr. Alberro is an international expert on petroleum and valuation. He has consulted for the United Nations, the International Monetary Fund and the World Bank. Dr. Hamm served as California’s non-partisan Legislative Analyst where he earned a nationwide reputation for objectivity, expertise and credibility on public policy issues.