On Wednesday, Governor Arnold Schwarzenegger announced his intention to sign several bills in response to the economic challenges faced by the subprime real estate market downturn — bills aimed at strengthing disclosure laws.

On Wednesday, Governor Arnold Schwarzenegger announced his intention to sign several bills in response to the economic challenges faced by the subprime real estate market downturn — bills aimed at strengthing disclosure laws.

We need to contrast these appropriate responses with the apparent desire by President Bush’s Treasury Secretary, Hank Paulson, to take a page out of the Presidency of Jimmy Carter, and promote welfare-statist approach to dealing with the negative effects of the market downturn on subprime lenders and their customers.

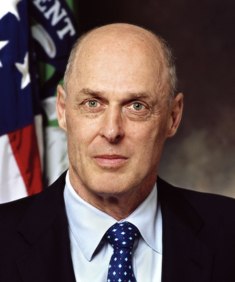

Did Secretary Paulson (pictured) learn anything at those Ivy League schools he attended? Even though some see him as a Godfather figure, you don’t have to be an Ivy Leaguer or Wall Street honcho to understand that rewarding poor behavior helps bring about more poor behavior. Most of us learned that lesson in kindergarten.

Yet rewarding poor behavior is exactly what Paulson and the government are considering as they ponder a bailout of the subprime mortgage industry. It is estimated that a government-backed bailout could cost taxpayers more than $100 billion – taxpayer funds that should be spent on addressing issues that affect the majority of us.

We don’t pay taxes to subsidize individual borrowers who are overextended or have been financially irresponsible. And we certainly shouldn’t have our tax dollars set aside to benefit irresponsible – even predatory – lenders that caused the entire subprime mortgage debacle in the first place.

Worse, it would allow these reckless players – lenders, banks, brokers – to keep their massive profits – a number of whom just happen to be Hank Paulson’s old financial service buddies. Is this a coincidence?

Consider that only five percent of all U.S. homeowners have subprime, adjustable-rate mortgages, and 85 percent of those loans are being paid on time. The subprime predicament isn’t about the overwhelming majority of homeowners. It’s about real estate speculators who undertook high-risk investments and have now foreclosed on properties due to market conditions.

Some in the financial industry will argue that the subprime mortgage crisis will further weaken U.S. banks, the national economy and even the global economy, considering the broad foreign investments in the United States’ financial ledgers. In August, financial press reported that international banks, especially those in Europe, had invested in “… collateralized debt markets, especially the subprime situation here in the U.S … (and were) suffering…” because of it.

To appease the concern, Paulson made the rounds the past couple months to countries such as England and France. At the time, Paulson’s public tune – it will “take a while to work through this turbulence,” as he was recently quoted in the Financial Times – had historical economic significance. Free market economists have long proposed that market ups and downs work themselves out over time, and that is the beauty of our free market economy.

But it may not be that easy for Paulson to keep a cool head with the lending industry breathing down his neck. For more than two decades, Paulson himself was reared in the womb of big banking and rose to chief executive officer at banking magnate Goldman Sachs prior to his appointment. His net worth as a result of his investment career is estimated at more than $700 million.

Some political missteps may also be apparent. Syndicated columnist Robert Novak writes about the liberal Democrats and Hillary Clinton backers Paulson is allying himself.

Amazingly, bloggers have pointed out that Paulson is being attacked as a partisan right-winger … or even the Bush Administration’s version of Dr. Evil.

And Paulson’s tune may be changing. Just a few weeks ago, speaking at a House banking panel, Paulson said he saw no “moral hazard” in the government looking at ways to assist the subprime meltdown. Federal Reserve Board Chairman Ben Bernanke sung a similar tune, saying he sees “no problem” with government-backed effort of some kind.

Has history taught us nothing? The Savings and Loan bailout should have taught us a lesson that cost taxpayers $124 billion, according to a 2000 review by the Federal Deposit Insurance Corporation.

It’s important to remember, however, that bailouts come in many different forms, including no-money-down FHA insured loans and allowing the government (read: taxpayers) to refinance $600,000 homes purchased with reckless speculative loans in the first place.

So what does Paulson really may think about the Subprime issue? Hard to say, but some sharp observers are not exactly brimming with confidence.

Think about the message a taxpayer bailout would send to those citizens working hard to pay their bills on time and uphold the obligations of their mortgage contracts.

At some point, we have to face the music as a nation. We have to realize that we live in a debt-riddled society governed by a debt-riddled government. When will this cycle of irresponsibility stop? It will stop when someone steps up and provides leadership. Let’s hope Paulson and  government officials can provide that leadership by remembering life lessons that hard-working taxpayers learned a long time ago.

government officials can provide that leadership by remembering life lessons that hard-working taxpayers learned a long time ago.

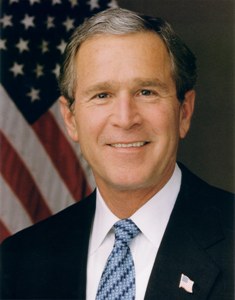

In the meantime Paulson’s boss, President Bush, has little time left in his tenure as our nation’s leader. He has set a tone for fiscal responsibility with his veto this week of the bloated State Children’s Health Insurance Program expansion bill. He should continue this course of fiscal restraint by nixing "government bail-out" off of Paulson’s play card.

Care to read comments, or make your own about today’s Daily Commentary?

Just click here to go to the FR Weblog, where this Commentary has its own blog post, and where you can read and make comments.